Except for tax protestors, no one wants to fight with the IRS. That’s why there’s such a mystique about avoiding an audit. While what-triggers-an-audit theories abound, there are some basic things you can do to reduce your chances of being picked for an audit or at least to make any interactions with the IRS less traumatic. Our advice doesn’t come with a guarantee.

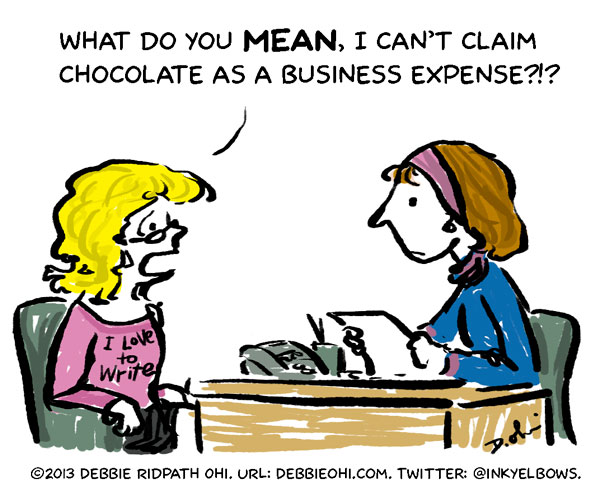

1. Don’t claim flaky tax deductions. So don’t be scared to take deductions and losses you’re entitled to, but don’t take tax positions you aren’t comfortable defending. If you take reasonable tax positions, you’ll likely find you won’t end up needing to defend them. And if you do face an audit, it will likely be far easier.

There are many old wives tales saying that certain items trigger an audit: home office deductions, passive losses, schedule C (sole proprietorship) activities, etc. You can’t predict the trigger (and you can drive yourself crazy trying), but you can adopt the “be reasonable” mantra about every item on your return, including these. So if you don’t have a decent claim for a home office, don’t claim it. If your money-losing sole proprietorship is really more a fun hobby, treat it as such.

2. Use a pro, or use software. Some argue a return prepared by a professional is less likely to be audited, but there’s little reliable data to support it. Nevertheless, having a professional prepare your return–or at least advise on anything quirky–is a good idea.

3. Disclose just enough. You’d be surprised how many professionals and amateurs alike try to submit too much information. If your return is complex, you may need to add explanations or disclosures in footnotes. Be concise, truthful and accurate, but don’t provide copies of sales agreements, settlement agreements, bank statements, etc., unless you are later asked to by the IRS.

4. Check your math. Make sure you add, subtract and multiply accurately. Check your numbers through each step and do some simple math checks when you finish. This is another reason to use a software program. Remember, even if you use a software program, you don’t have to file electronically. You can print out your returns and mail them in. If you do make a math mistake, you are likely to get a math correction notice from the IRS. This isn’t an audit. But your goal is to minimize such interaction with the IRS bureaucracy, which isn’t known for the best mail handling practices.

5. Account for every Form 1099. Form 1099 comes in many varieties, including 1099-INT for interest, 1099-DIV for dividends, 1099-G for tax refunds, 1099-R for pensions and 1099-MISC for miscellaneous income. These forms are sent by payers of such funds to both you and the IRS. So regardless of how many 1099s you receive, make sure they all are accounted for on your return. There are also Forms 1098 which lenders send (to you and the IRS) recording how much interest you paid. The IRS matches your return against the 1098s and 1099s. So one way to guarantee an IRS query is to fail to account for something. If a Form 1099 is wrong–say it reports more income than you had–you can explain or deduct it on the return, but you need to first report it.

A last word: No matter how careful you are, there’s no way to guarantee you’ll never have a tax controversy. Sometimes your number just comes up. While audit rates for most types of tax returns are low, there is always a chance you will be examined. Try to be ready.

PRIVILEDGED & CONFIDENTIAL

1) Do not read, copy or disseminate this communication unless you are the intended addressee. This Email communication contains confidential &/or privileged information intended for the addressee. If you receive this transmission in error, treat it confidential & contact the person listed above.

2) Rink & Robinson, PLLC shall not be liable for the improper or incomplete transmission of the information contained in this communication nor for any delay in its receipt or damage to your system. We do not guarantee that the integrity of this communication, including attachments, has been maintained nor that this communication is free of viruses, interceptions or interference.

3) Any reliance on the information contained in this correspondence by someone who has not entered into an engagement with Rink & Robinson, PLLC is taken at the reader’s own risk.